Whole Farm Revenue Protection - An Overview

8 Simple Techniques For Whole Farm Revenue Protection

Table of ContentsThe Definitive Guide for Whole Farm Revenue ProtectionWhole Farm Revenue Protection Can Be Fun For EveryoneWhole Farm Revenue Protection Things To Know Before You BuyThe Buzz on Whole Farm Revenue ProtectionWhat Does Whole Farm Revenue Protection Mean?The Ultimate Guide To Whole Farm Revenue ProtectionSome Known Questions About Whole Farm Revenue Protection.

Farm and also ranch home insurance coverage covers the properties of your ranch and cattle ranch, such as livestock, equipment, buildings, installments, and others. Believe of this as industrial building insurance that's solely underwritten for companies in agriculture. These are the usual coverages you can obtain from ranch as well as ranch home insurance policy. The tools, barn, equipment, equipment, animals, materials, and also device sheds are useful properties.Your ranch and ranch utilizes flatbed trailers, enclosed trailers, or energy trailers to haul products and also devices. Industrial vehicle insurance will certainly cover the trailer however only if it's affixed to the insured tractor or vehicle. If something takes place to the trailer while it's not attached, then you're left on your own.

Employees' payment insurance offers the funds a worker can use to purchase drugs for an occupational injury or illness, as prescribed by the medical professional. Workers' settlement insurance coverage covers rehab.

Whole Farm Revenue Protection Fundamentals Explained

You can insure yourself with workers' compensation insurance. While acquiring the plan, providers will certainly offer you the liberty to consist of or exclude yourself as a guaranteed.

Excitement About Whole Farm Revenue Protection

The right one for your farm vehicle and also scenario will differ depending on a number of elements. Numerous farm insurance coverage providers will likewise supply to compose a farmer's car insurance. It can be advantageous to couple policies with each other from both a protection and cost perspective. In some situations, a ranch insurance provider will just offer certain kinds of automobile insurance or guarantee the auto dangers that have operations within a particular scope or scale.

No issue what provider is writing the farmer's car insurance coverage, heavy and also extra-heavy trucks will require to be put on a business automobile policy. Trucks entitled to a commercial farm entity, such as an LLC or INC, will need to be placed on an industrial plan despite the insurance policy service provider.

If a farmer has a semi that is used for carrying their very own ranch items, they might have the ability to include this on the very same commercial vehicle policy that insures their commercially-owned pickup. However, if the semi is utilized in the off-season to transport the products of others, many basic farm and business auto insurance providers will certainly not have an "hunger" for this sort of danger.

Examine This Report about Whole Farm Revenue Protection

A trucking plan is still internet a commercial automobile plan. The service providers who supply insurance coverage for procedures with lorries utilized to haul products for Third events are generally specialized in this kind of insurance coverage. These sorts of operations produce higher risks for insurance companies, bigger insurance claim quantities, as well as a greater extent of claims.

A seasoned independent agent can help you analyze the kind of policy with which your industrial car must be insured and describe the nuanced implications as my response well as insurance coverage implications of having multiple vehicle plans with various insurance providers. Some trucks that are utilized on the ranch are insured on individual auto plans.

Business automobiles that are not eligible for an individual vehicle plan, yet are utilized exclusively in the farming operations use a lowered danger to insurance policy firms than their commercial use equivalents. Some service providers decide to guarantee them on a ranch vehicle plan, which will have slightly various underwriting standards and also rating frameworks than a routine industrial auto plan.

Little Known Facts About Whole Farm Revenue Protection.

Many farmers delegate older or restricted usage vehicles to this type of enrollment since it is a cost-effective means to keep a vehicle being used without all of the additional expenses typically associated with autos. The Division of Transport in the state of Pennsylvania categorizes a number of various kinds of unlicensed ranch trucks Type A, B, C, as well as D.

Time of day of usage, miles from the home ranch, as well as other constraints relate to these kinds of lorries. It's not an excellent suggestion to delegate your "daily driver" as an unlicensed farm automobile. As you can see, there are multiple sorts of ranch truck insurance plan readily available to farmers.

The 45-Second Trick For Whole Farm Revenue Protection

It is very important to review your automobiles and their use openly with your representative when they are structuring your insurance coverage portfolio. This type of detailed, conversational strategy to the insurance coverage buying procedure will assist to guarantee that all protection gaps are shut and you are obtaining the best value from your plans.

Please note: Info and also cases offered in this content are meant for insightful, illustratory objectives as well as need to not be considered legitimately binding.

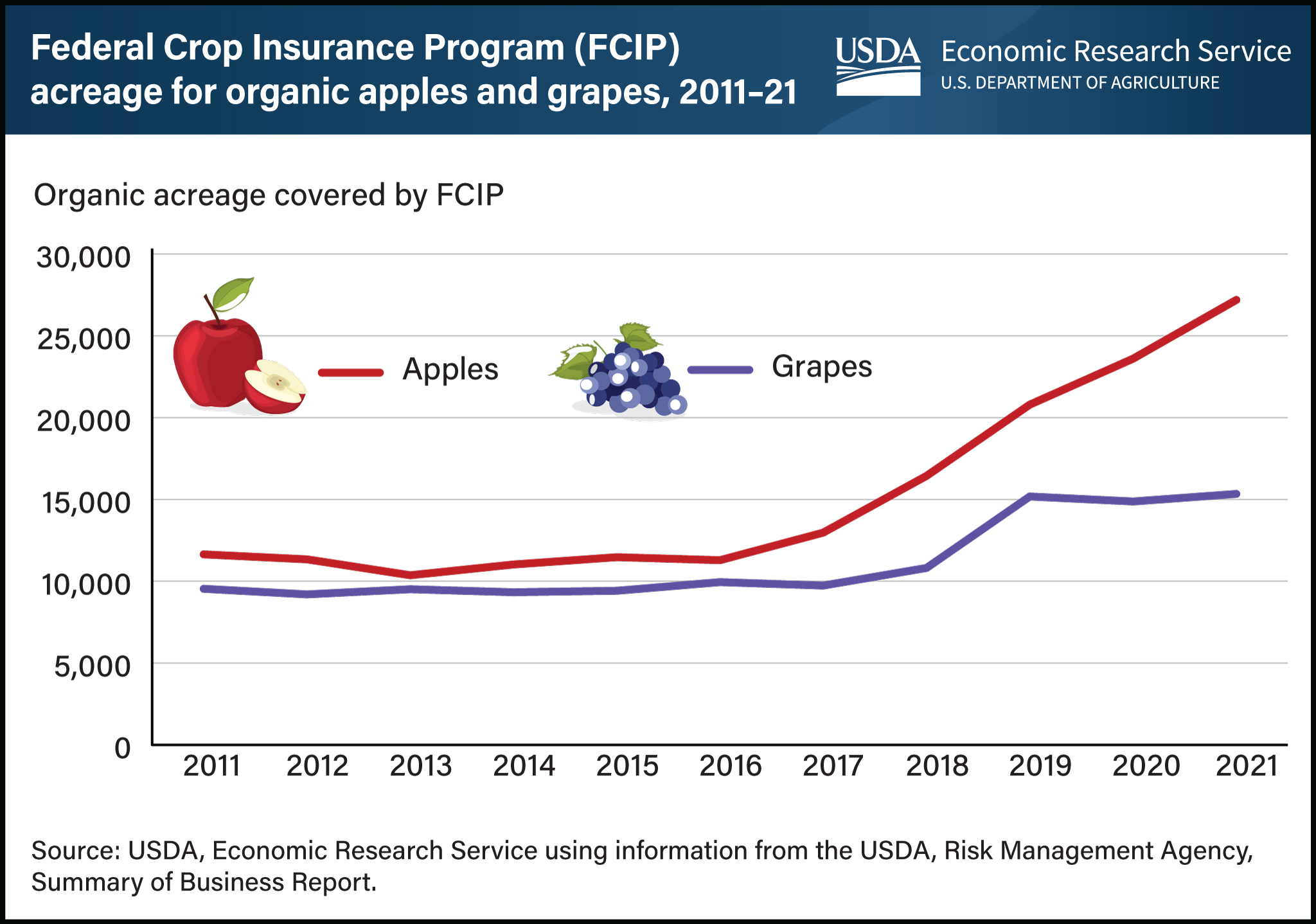

Plant hail protection is offered by private insurance firms and also controlled by the state insurance my response divisions. It is not part of a federal government program. There is a government program supplying a variety of multi-peril plant insurance coverage items. The Federal Crop Insurance policy program was developed in 1938. Today the RMA carries out the program, which provided plans for greater than 255 million acres of land in 2010.

Whole Farm Revenue Protection Things To Know Before You Buy

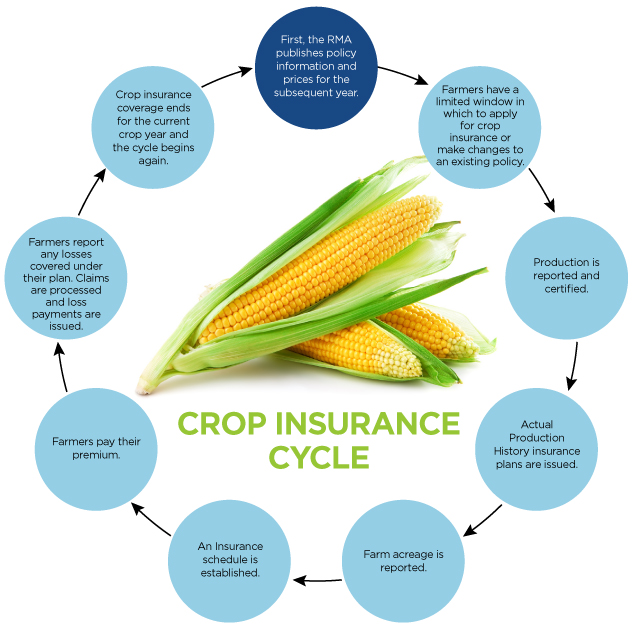

Unlike various other types of insurance coverage, crop insurance policy is reliant on well-known dates that use to all plans. These are the essential days farmers need to anticipate to fulfill: All crop insurance coverage applications for the assigned region as well as plant are due by this date.